Green banking has gained international recognition because of its critical role in funding economic endeavors to achieve sustainable growth and development objectives. It alludes to the idea that national banking rules should consider social and environmental considerations. This entails creating ‘green factories’ and committing to several long-term renewable energy, environmentally beneficial, and climate-resilient projects. It became quite popular among banks after the Paris Climate Agreement, which helped to stimulate investments in forestry projects, renewable energy, and carbon offsets.

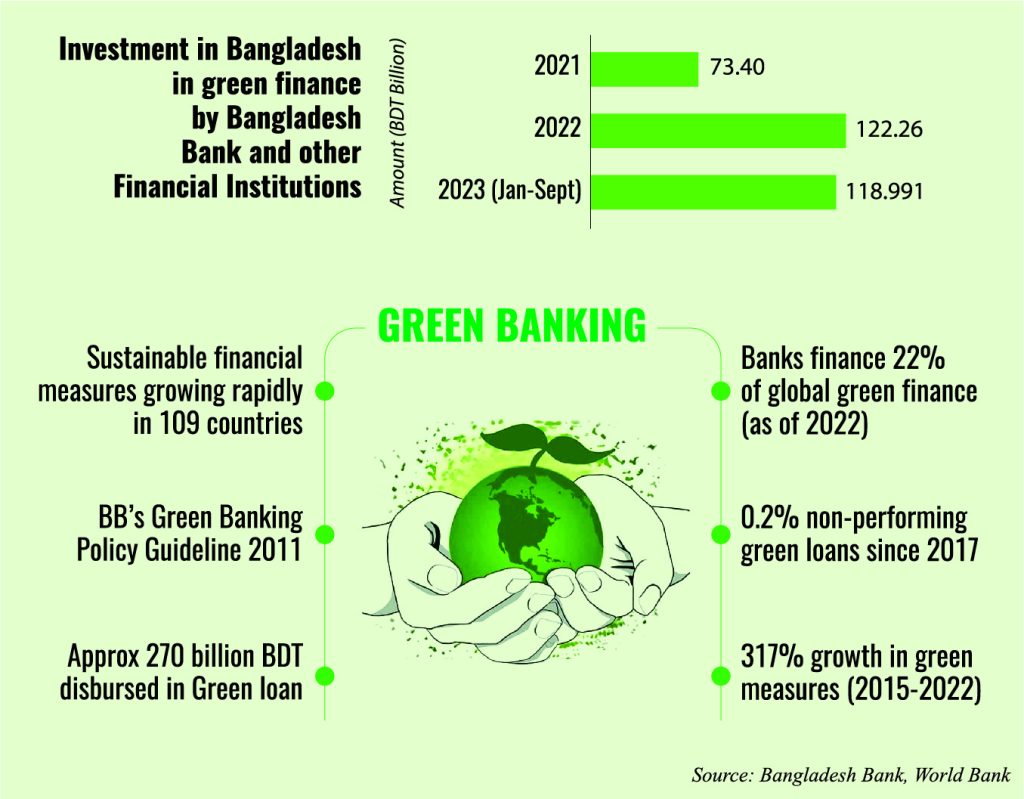

The central bank of Bangladesh, the Bangladesh Bank, started implementing green banking programs in 2009 realizing its importance. Commercial banks must publish green banking guidelines released by BB in 2011 and submit quarterly reports to BB to comply with the mandatory green banking standards. This innovative measure in Bangladesh is the first of its kind in Asia. The concept of sustainable banking operations, which aims to incorporate ESG (Environmental, Social, and Governance) factors in decision-making processes, is becoming increasingly popular.

Bangladesh Bank intends to require banks and other financial institutions to invest in green projects. According to these rules, they must provide 15% of their loans to sustainable financing, 2% of which will go toward green financing. BB has required all banks and non-bank financial institutions (NBFIs) doing business nationwide to achieve a minimum 5% target for green finance. Therefore, commercial banks must implement necessary measures to avert environmental harm, whether financing new ventures or furnishing operational cash to established enterprises is imperative.

Banks are advised to give their customers the utmost care when establishing Letters of Credit (L/C) for installing Effluent Treatment Plants (ETP) in industrial units, and support solar energy, biogas, ETP, and hybrid Hoffman kilns (HHK) in the brick business as part of BB’s refinance strategy. The Bangladesh Bank has started various initiatives to assist banks and other financial institutions. It evaluates and ranks banks and NBFIs annually based on how well they offer green loans.

These funding choices are now accessible in Bangladesh over 117, an increase from 68 the previous year. Solar parks and residences, wind and biogas power plants, recycling and waste management, and organic farming are some examples. In addition to banks, the market is also populated by insurance brokers and microfinance institutions, who, among other things, offer minor loans and insurance for agricultural uses. Furthermore, loans to the agriculture sector in general and cottage, micro, small, and medium-sized enterprises in particular have been given top priority by the Bangladesh Bank.

The SAJIDA Foundation released the nation’s first green bond last year. Bangladesh Bank reports that in the first quarter of 2023, banks approved Tk 35,387 crore, an increase of more than 40% year over year. This results from lenders lending more money to environmentally conscious businesses and industries. Bank-provided green funding increased by 65% year over year to Tk 2,775 crore in the first quarter of 2023. Tk 16.89 billion was the total for the January–March quarter of 2022.

However, some challenges need to be addressed: product diversification, a lack of energy consciousness in implementing energy-efficient office time management and green building practices, insufficient funding for the country’s mass transit system, and a lack of desire for more socially responsible services. The underdeveloped equity and bond markets, the incapacity of banks and other financial institutions, and the lack of knowledge regarding the risks and returns of green projects hamper the expected growth of green projects in Bangladesh. Finding a balance between sustainability and profitability is one of the main issues.

Bangladesh needs to consider the long term when updating its policy standards. Banks are not the only financial actors with a bigger say in how most policies are made. Company executives must be persuaded of the importance of green finance for the next generation by exchanging information. Banking practices must be improved to address climate change and create a sustainable future. To ensure that green banking transforms from a concept into a transformative force that enhances the nation’s financial environment, persistent dedication, inventiveness, and collaboration are required.

MD Shiyan Sadik is an environmental economist currently working as a Lecturer at North South University. He is an experienced columnist who has advocated several climate-related issues through his articulation for several blogs, and national and International daily.